Apple Inc. signed a new multiyear, multibillion-dollar deal with Broadcom Inc. to get 5G radio frequency components for its devices, extending a sometimes-contentious relationship between two of the world’s biggest tech companies.

The collaboration will include wireless connectivity parts and FBAR filters, which help mobile phones focus airwave signals and reduce interference, Apple said in a statement on Tuesday. The FBAR filters will be designed and built in several US manufacturing hubs, including Fort Collins, Colorado, where Broadcom has a major facility.

The move offers some reassurance to Broadcom investors worried about Apple reducing its reliance on the chipmaker. For Apple, the deal helps ensure that it gets the supplies it needs after a tumultuous stretch during the pandemic. And the pact lets the iPhone maker point to progress in getting components from US sources, though the company is still overwhelmingly dependent on Asia — and particularly China — for its supply.

The agreement also may help alleviate Apple’s dependence on Qualcomm, the biggest maker of smartphone chips, Bloomberg Intelligence analyst Anurag Rana said in a report. It’s another indication of Apple’s “intentions to diversify its supply chain, both from a vendor and geography perspective,” he said.

Shares of San Jose, California-based Broadcom rose about 1% following the announcement, with Apple dipping less than 1%. Qualcomm shares also fell less than 1%.

Apple vowed in 2021 to pump $430 billion into the US economy over the next five years, and this latest deal will help it stay on pace to meet that target. The company already helps support more than 1,000 jobs in Fort Collins, and the partnership will enable Broadcom to continue to invest in automation projects, Apple said.

“We’re thrilled to make commitments that harness the ingenuity, creativity and innovative spirit of American manufacturing,” Apple Chief Executive Officer Tim Cook said. “All of Apple’s products depend on technology engineered and built here in the United States, and we’ll continue to deepen our investments in the US economy because we have an unshakable belief in America’s future.”

The iPhone maker is spending tens of billions of dollars to develop 5G technology, which is expected to help power the next generation of consumer electronics. 5G offers quicker response times and 10-fold speed improvements that are needed for features like autonomous vehicles and virtual reality gaming.

In broad strokes, Tuesday’s agreement maintains the status quo. It extends a three-year pact that the companies signed in 2020. But the companies’ relationship has been strained over the years, and Apple is making a long-term push to produce more of its components in-house. That has put its dealings with Broadcom — and Qualcomm — under close scrutiny.

Apple also is putting more emphasis on where supplies are produced, at a time when politicians are focused on boosting domestic manufacturing of vital electronic components.

Apple is Broadcom’s largest customer, accounting for about 20% of the chipmaker’s revenue in the last fiscal year. That amounted to almost $7 billion. Qualcomm got 22% of its annual sales from the iPhone maker, representing nearly $10 billion.

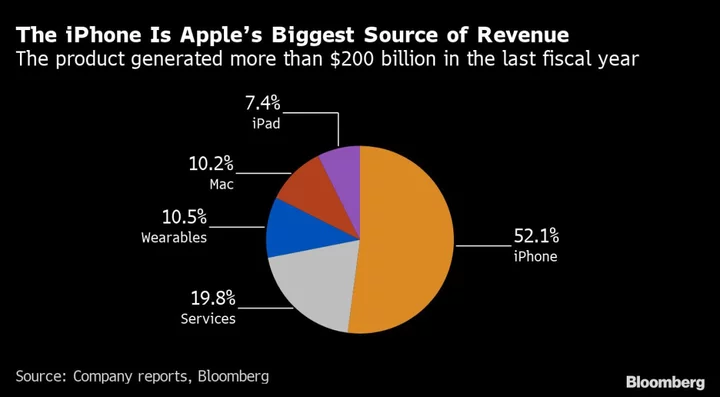

The iPhone is Apple’s top moneymaker, generating more than half of its $394.3 billion in revenue last year. The phone also has helped fuel growth at Broadcom, which refers to Apple as its “large North American customer” during earnings calls. The chipmaker makes a combined component that handles both Wi-Fi and Bluetooth functions on Apple devices.

In addition, Broadcom makes the short-range connectivity for mobile phones and the so-called RF front end, which manages radio signals that the phone needs to transmit and receive cellular communications. Qualcomm is the dominant maker of modems, the chips that take those radio signals from the RF front end and convert them into the data used by the phone. Qualcomm typically supplies the RF front end and modem to its customers, but Apple only uses its modems.

Cupertino, California-based Apple has been pushing to replace the chips inside its devices with homegrown components and is looking to swap out Broadcom with its own Bluetooth and Wi-Fi chip in the coming years, Bloomberg has reported.

As part of the shift, Apple also aims to ready its first cellular modem chip by the end of 2024 or early 2025, letting it replace electronics from Qualcomm too. Apple is also working to develop its own RF component, but that will take years, and the company will need to rely on Broadcom in the meantime.

Hock Tan, the chipmaker’s CEO, has a reputation for tough negotiations and has forced customers to commit to noncancelable orders. But he’s also shown signs of wavering in his commitment to Apple. Prior to the companies’ 2020 agreement, Tan indicated that Broadcom might divest the business that supplies chips to the iPhone.

--With assistance from Scott Moritz.

(Updates with more on deal’s implications starting in third paragraph.)