WASHINGTON--(BUSINESS WIRE)--Oct 6, 2023--

Today, Apartments.com – a CoStar Group online marketplace – published an in-depth report of multifamily rent growth trends for the third quarter of 2023. Imbalances between supply and demand continue to plague the once fast-growing Sun Belt markets, while markets in the Northeast and Midwest round out the top rent growth leaders.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231006135376/en/

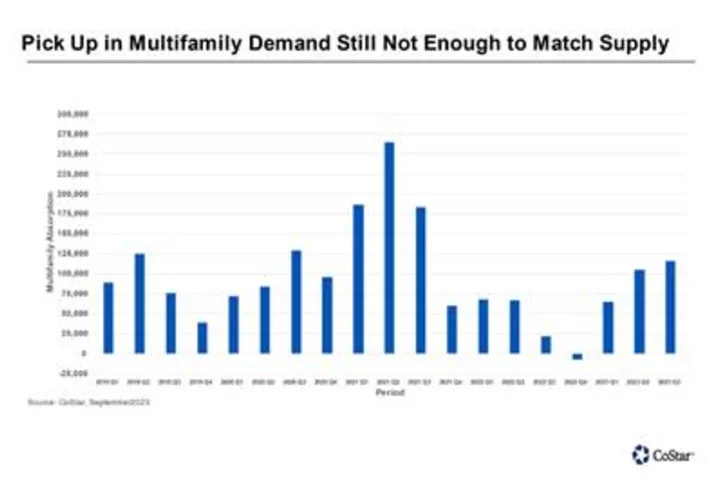

Pick Up in Multifamily Demand Still Not Enough to Match Supply (Graphic: Business Wire)

“Despite third quarter demand hitting its highest level since 2021, it was not enough to match the new supply that came online,” said Jay Lybik, National Director of Multifamily Analytics at CoStar Group. “The supply-demand imbalance caused national vacancy rates to move up again, but at a slow pace, providing positive signals that the multifamily market is approaching stabilization.”

INCREASED DEMAND STILL OUTSTRIPPED BY NEW SUPPLY

In the third quarter, demand reached its highest level since 2021 at 116,000 units. However, it wasn’t enough to match the 140,000 units of new supply that hit the market, causing the national vacancy rate to move up 10 basis points to 7.0%. The rise in vacancy marks the slowest increase since the vacancy rate began ascending at the end of 2021, signaling that the market could be on the cusp of stabilizing.

SUN BELT MARKETS FACE LARGEST SUPPLY-DEMAND IMBALANCE

Upward pressure on vacancy has led year-over-year asking rent growth to decelerate from 1.3% to 0.8% over the last 90 days. Sun Belt markets, which experienced the fastest rent growth in 2021 and the first half of 2022, are now facing the largest imbalance between supply and demand with developers delivering record numbers of units and too few new renter households to fill them.

Many of these markets finished the third quarter with negative year-over-year rent growth, particularly Atlanta and Austin, which witnessed their rent growth vanish from 17.0% at the end of 2021 to negative 3.1% and negative 4.8% respectively.

NORTHERN NEW JERSEY, CINCINNATI LEAD RENT GROWTH

On the other hand, Midwest and Northeast markets dominate the top 10 list for rent growth. Northern New Jersey and Cincinnati held the top rent growth spot at 3.4% in the third quarter, with both regions experiencing limited new supply additions, allowing multifamily conditions to remain significantly more balanced than in Sun Belt markets.

VACANCY TICKS UP FOR HIGH-END PROPERTIES, MID-MARKET REMAINS THE BRIGHT SPOT

With an estimated 554,000 units of new supply coming online this year, the multifamily market is approaching the most deliveries since the mid-1980s. Of these, 70% are aimed at the top end of the market, pushing 4- and 5-star vacancy rates up 300 basis points to 9.1% at the end of September and bringing annual rent growth further down at negative 0.4%.

Conversely, demand for mid-market priced rental units rebounded in the first three quarters of 2023 with new supply additions at a fraction of those in the luxury price range. While 3-star rent growth slipped slightly over the past three months, it remains positive at 1.4% and above the overall average of 0.8%. If the economy is able to avoid a recession and pent-up household formations start releasing, it’s possible that 3-star properties could begin to stabilize and start recovering in 2024, a direct contrast to the top-end of the market which will continue to battle elevated supply levels throughout 2024.

LOOKING AHEAD

Property operations for the remainder of 2023 and going into 2024 will vary widely depending on the market and the price point. Sun Belt markets and luxury properties appear most at risk for further weakness due to oversupply conditions, while Midwest/Northeast locations and mid-priced 3-star properties could outperform.

About CoStar Group

CoStar Group (NASDAQ: CSGP) is an S&P500 leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. Thomas Daily is Germany’s largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group’s websites attract over 160 million unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

About Apartments.com

Apartments.com is the leading online apartment listing website, offering renters access to information on more than 1,000,000 available units for rent. Powered by CoStar, the Apartments.com Network of sites includes Apartments.com, ApartmentFinder.com, ApartmentHomeLiving.com, Apartamentos.com, WestsideRentals.com, ForRent.com, ForRentUniversity.com, After55.com and CorporateHousing.com.

Apartments.com is supported by the industry's largest professional research team, which has visited and photographed over 500,000 properties nationwide. The team makes over one million calls each month to apartment owners and property managers, collecting and verifying current availabilities, rental rates, pet policies, fees, leasing incentives, concessions, and more. Apartments.com offers more rental listings than any other apartments website, and innovative features including a drawing tool that allows users to define their own search areas on a map, and a "Travel Time" feature that lets users search for rentals in proximity to a specific address. Apartments.com creates easy access to its listings through a responsive website and iOS and Android apps, and provides unmatched exposure for its advertisers through an intuitive name, strategic search engine placements and innovative emerging media.

The Apartments.com Network reaches millions of renters nationwide, driving both qualified traffic and highly engaged renters to leasing offices.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2022 and Forms 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023, each of which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website ( www.sec.gov ). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com:https://www.businesswire.com/news/home/20231006135376/en/

CONTACT: News Media Contact

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com

KEYWORD: DISTRICT OF COLUMBIA UNITED STATES NORTH AMERICA

INDUSTRY KEYWORD: OTHER CONSTRUCTION & PROPERTY RESIDENTIAL BUILDING & REAL ESTATE COMMERCIAL BUILDING & REAL ESTATE CONSTRUCTION & PROPERTY

SOURCE: CoStar Group

Copyright Business Wire 2023.

PUB: 10/06/2023 01:03 PM/DISC: 10/06/2023 01:02 PM

http://www.businesswire.com/news/home/20231006135376/en