By Huw Jones and Carolyn Cohn

LONDON Britain's plans for nudging billions of pounds of pension cash into new UK companies to boost growth and increase stock market listings leave challenges of keeping investor fees competitive and finding enough funds.

Under the so-called "Mansion House Compact" announced in July by finance minister Jeremy Hunt, 10 companies have volunteered to invest 5% of their direct contribution (DC) pension pots, or about 50 billion pounds ($62.31 billion) in total, by 2030 in companies listed on the LSE's junior AIM market, rival Aquis Exchange, or not listed at all to help them grow.

Hunt on Wednesday announced his first steps to help implement the compact, including a new fund set up by the British Business Bank for pension schemes to invest in growth companies. Such a pooled approach is aimed at small schemes that lack expertise to research fledgling companies.

"The best way to achieve the important task of divesting asset allocation of DC funds into small growth companies and unlisted equity is to put together a range of funds specially designed for collective investment," said Ros Altmann, a former UK pensions minister.

The government's cocktail of measures could take time to make a measurable difference, however, given the uphill task in a fragmented sector where consolidation has barely begun.

Investments from direct benefit (DB) pension schemes, one of the largest parts of the sector, in UK listed companies have dropped from 48% in 2000 to just 6% by 2020, or nearly 2 trillion pounds, with cash redirected to less risky government bonds and heavily traded global blue chip stocks, according to New Financial think tank.

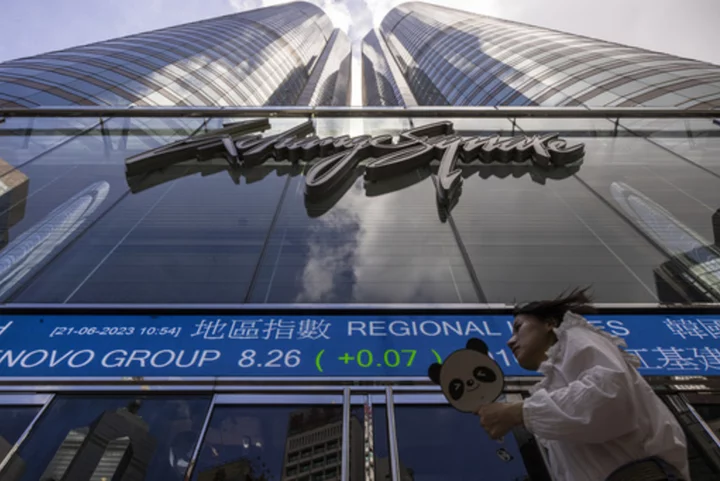

This has shrank London as a listings centre just as it faces tougher competition from New York, and also from European Union centres since Brexit.

Not surprisingly, the government has faced calls from the City to move faster with its plans and dismayed some by not putting forward a pensions law to mandate change and more rapid industry consolidation into bigger schemes with expertise to invest in growth companies.

Britain is initially targeting DC pension schemes, a growing alternative to DB schemes, but critics say that low contribution rates mean the funds are not building up fast enough to bring speedy results.

"That's first and foremost an issue that needs addressing," said James Brundrett, senior investment consultant at Mercer, a compact signatory.

Assets in such schemes totalled 605 billion pounds in 2020, according to the Pensions and Lifetime Savings Association, which sees growth to 955 billion by 2030.

LID ON FEES

Less frequently traded stocks like fledgling companies tend to be more expensive to trade than blue chips, but asset managers are loath to ask customers to pay more at a time when regulators are pushing hard on "value for money".

"Historically there has been a heavily weighted focus on cost, rather than value, and we think that needs to change," said Paul Bucksey, chief investment officer at compact signatory Smart Pension.

"Employers and consultants need to spend more time reviewing potential providers’ investment propositions, rather than just focusing on fees."

Jesal Mistry, senior DC investment director at Legal & General Investment Management, also a compact signatory, said investing in private markets has a "real role to play" in shifting schemes away from a pure focus on costs.

NO MANDATING

A senior executive at another company that has signed the Mansion House Compact said all its signatories should explain how they are meeting the 5% target, given it is a voluntary framework.

So far the government, and the opposition Labour Party, tipped in the polls to win a general election anticipated for next year, have said they won't mandate what pension funds invest in.

Pensions Regulator chief Nausicaa Delfas said last month it was ultimately for scheme trustees to decide where to invest, but warned that the industry must "shift" its approach to create bigger, better run schemes that make it easier to invest in a wider range of assets, including private assets.

Andrew Griffith, then City minister, said this month that there was no law stopping investment in riskier assets that needed reversing, adding that it was down to codes of practices which regulators could tackle directly.

"It's the fine detail where those little nudges are, and we can change that."

Others agree.

"On DC I think they should be able to just have a principles based approach and get on with it," Mercer's Brundrett said.

Nest said it has found ways to put cash into illiquid assets and alternative markets under existing rules.

Alison Leslie, head of DC investment at Hymans Robertson, said it will "take some time" for the reforms to be commercially viable for many pension arrangements.

Others are more optimistic.

"If there's capital that starts to be allocated more to UK companies, I think you'll start to see the benefits of that in relatively short order, over the next year or two or three," London Stock Exchange Group CEO David Schwimmer said, but added that progress is needed.

($1 = 0.8025 pounds)

(Additional reporting by Iain Withers, Editing by Christina Fincher)