It was a day that started with something of a bang: the charismatic Alex Mashinsky, former chief executive officer of bankrupt crypto lender Celsius Network under arrest and charged with fraud.

In a flurry of enforcement activity, the US Department of Justice, Securities and Exchange Commission, Commodity Futures Trading Commission, and the Federal Trade Commission all filed lawsuits against both Mashinsky and Celsius itself.

Allegations against Mashinsky ranged from pumping up the price of CEL, the lender’s native token, to wire fraud. Mashinsky has pleaded not guilty and will be released on bail after agreeing to a $40 million personal recognizance bond.

Read: Celsius and Mashinsky: The Most Striking Indictment Details

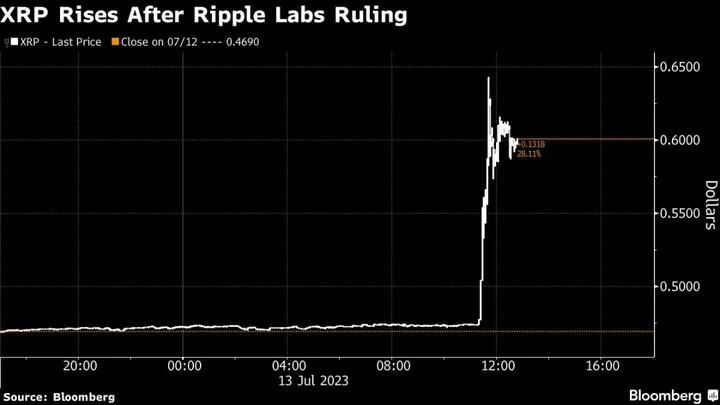

Then, shortly before noon, a judge issued a long-awaited ruling in the case of the SEC v Ripple Labs Inc. that sent crypto Twitter into a frenzy and token prices soaring. US District Judge Analisa Torres held that XRP, the token associated with Ripple Labs and central to the case, is a security when offered to institutional investors but not the general public.

“Institutional buyers would have understood that Ripple was pitching a speculative value proposition for XRP with potential profits to be derived from Ripple’s entrepreneurial and managerial efforts,” the judge wrote.

Read: Ripple Tokens Sold to Public Are Not Securities, Judge Says

But Torres ruled that finding didn’t apply to programmatic investors, meaning the broader public. She said there was no evidence that such investors could parse the many statements made by Ripple about XRP, and found that many statements cited by the SEC may not have been shared with the broader public.

Whether cryptocurrencies are securities has been a major question hanging over the industry, which has long fought efforts to regulate it by arguing that the tokens do not meet the necessary criteria.

XRP almost doubled, soaring to as much as 94 cents. Other tokens that were recently described as unregistered securities by the SEC such as Solana and Cardano also increased, rising around 19% and 16%, respectively. Bitcoin, the oldest of the coins, edged higher to $31,189.50.

“Judge Torres’ decision in Ripple is a huge win for the cryptocurrency and digital asset industry,” said Arthur G. Jakoby, co-chair for Securities Litigation and Enforcement at the law firm Herrick Feinstein LLP. “If upheld on appeal, this decision significantly narrows the SEC’s jurisdiction over the crypto market.”

Shares of crypto-dependent companies also rallied. Coinbase Global Inc. rose the most since its public debut, climbing as high as $109.21. The exchange is embroiled in a lawsuit of its own with the SEC that alleges that it sold tokens that are unregistered securities.

“This underscores that direct sales of digital assets by an issuer will often be securities, but other sales, most notably sales on the secondary market, are unlikely to be deemed securities, which is a key argument in Coinbase’s defense against the SEC,” said Elliott Stein, Bloomberg Intelligence senior analyst for litigation.

MicroStrategy jumped more than 10% and crypto miner Marathon Digital closed more than 14% higher on the day.

“My overall impression is this is a positive decision for the digital asset industry,” said Daniel Tramel Stabile, partner at Winston & Strawn. “The court expressly concluded that XRP is not, in and of itself, a security. Instead, the focus must be on the circumstances of the offering itself.”

The SEC sued San Francisco-based Ripple and top executives in December 2020. At the time, the regulator accused the company, co-founder Christian Larsen and Chief Executive Officer Brad Garlinghouse of misleading investors in XRP by selling more than $1 billion worth of the tokens without registering them, depriving investors of information about the cryptocurrency and about Ripple’s business.

Even prior to the day’s enthusastic price action, cryptocurrencies have been on a tear.

In recent weeks, a raft of filings for spot Bitcoin ETFs in the US, driven in large part by an application by Wall-Street heavyweight BlackRock Inc., has reinvigorated traders who’d been buffetted by the long crypto winter.

Bitcoin has risen around 90% since December after falling 64% in the aftermath of a string of industry scandals and bankruptcies, including that of Mashinsky’s Celsius.

Read: Novogratz Sees Bitcoin Rising, Says ETFs Likely to Be Approved

--With assistance from David Pan, Chris Dolmetsch and Allyson Versprille.

(Recasts throughout)