CHRISTIANSTED, U.S. Virgin Islands--(BUSINESS WIRE)--May 15, 2023--

Altisource Asset Management Corporation (“AAMC” or the “Company”) (NYSE American: AAMC) today announced financial and operating results for the first quarter of 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230515005457/en/

First Quarter 2023 Results and Recent Developments (Graphic: Business Wire)

First Quarter 2023 Results and Recent Developments

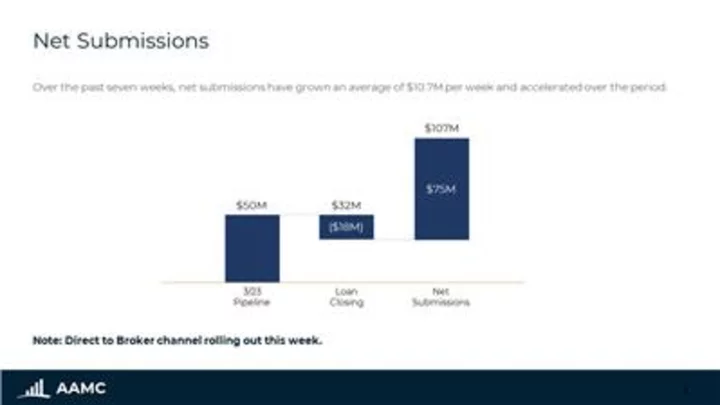

- Through May 12, 2023, the Company has received total net loan submissions of $107 million from both its direct to borrower and wholesale channels.

- The Company entered into forward contracts to sell alternative credit products to three additional institutional counterparties, bringing our total to five, that manage insurance and credit investments. One of the new institutions has over $500 billion in assets under management.

- AAMC repurchased 27,441 shares of its common stock for a total of $1.5 million during the first quarter of 2023.

- First quarter earnings improved by $1.1 million, reducing the first quarter loss to $3.0 million on revenue of $2.1 million from the fourth quarter 2022.

About AAMC

AAMC is a private credit provider that originates alternative assets to provide liquidity and capital to under-served markets. Additional information is available at www.altisourceamc.com.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections, anticipations, and assumptions with respect to, among other things, the Company’s financial results, margins, employee costs, future operations, business plans including its ability to sell loans and obtain funding, and investment strategies as well as industry and market conditions. These statements may be identified by words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,” “estimate,” “target,” “seek,” “believe,” and other expressions or words of similar meaning. We caution that forward-looking statements are qualified by the existence of certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors that could cause our actual results to differ materially from these forward-looking statements may include, without limitation, our ability to develop our businesses, and to make them successful or sustain the performance of any such businesses; our ability to purchase, originate, and sell loans, our ability to obtain funding, market and industry conditions, particularly with respect to industry margins for loan products we may purchase, originate, or sell as well as the current inflationary economic and market conditions and rising interest rate environment; our ability to hire employees and the hiring of such employees; developments in the litigation regarding our redemption obligations under the Certificate of Designations of our Series A Convertible Preferred Stock; and other risks and uncertainties detailed in the “Risk Factors” and other sections described from time to time in the Company’s current and future filings with the Securities and Exchange Commission. The foregoing list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the date of this press release only. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, whether as a result of new information, future events or otherwise.

| Altisource Asset Management Corporation Condensed Consolidated Statements of Operations (In thousands, except share and per share amounts) (Unaudited) | |||||

Three months ended March 31, | |||||

2023 | 2022 | ||||

Revenues: | |||||

Loan interest income | $ | 2,036 | $ | — | |

Loan fee income | 85 | — | |||

Realized gains on loans held for sale, net | 10 | — | |||

Total revenues | 2,131 | — | |||

Expenses: | |||||

Salaries and employee benefits | 1,864 | 924 | |||

Legal fees | 441 | 1,357 | |||

Professional fees | 480 | 266 | |||

General and administrative | 934 | 729 | |||

Servicing and asset management expense | 183 | — | |||

Acquisition charges | — | 424 | |||

Interest expense | 1,082 | — | |||

Direct loan expense | 263 | — | |||

Loan sales and marketing expense | 409 | — | |||

Total expenses | 5,656 | 3,700 | |||

Other income (expense): | |||||

Change in fair value of loans | 849 | — | |||

Realized losses on sale of held for investment loans, net | (275 | ) | — | ||

Other | (2 | ) | 8 | ||

Total other income | 572 | 8 | |||

Net loss before income taxes | (2,953 | ) | (3,692 | ) | |

Income tax expense (benefit) | 35 | 5 | |||

Net loss attributable to common stockholders | $ | (2,988 | ) | (3,697 | ) |

Gain on preferred stock transaction | — | 5,122 | |||

Numerator for earnings per share | $ | (2,988 | ) | $ | 1,425 |

(Loss) income per share of common stock – Basic: | |||||

(Loss) income per basic common share | $ | (1.68 | ) | $ | 0.69 |

Weighted average common stock outstanding | 1,777,135 | 2,056,666 | |||

(Loss) income per share of common stock – Diluted: | |||||

(Loss) income per diluted common share | $ | (1.68 | ) | $ | 0.66 |

Weighted average common stock outstanding | 1,777,135 | 2,174,002 |

| Altisource Asset Management Corporation Condensed Consolidated Balance Sheets (In thousands, except share and per share amounts) | ||||

March 31, 2023 | December 31, 2022 | |||

(unaudited) | ||||

ASSETS | ||||

Loans held for sale, at fair value | $ | 13,475 | $ | 11,593 |

Loans held for investment, at fair value | 65,316 | 83,143 | ||

Cash and cash equivalents | 11,836 | 10,727 | ||

Restricted cash | 2,049 | 2,047 | ||

Other assets | 10,642 | 10,137 | ||

Total assets | $ | 103,318 | $ | 117,647 |

LIABILITIES AND EQUITY | ||||

Liabilities | ||||

Accrued expenses and other liabilities | $ | 8,862 | $ | 10,349 |

Lease liabilities | 1,232 | 1,323 | ||

Credit facilities | 43,234 | 51,653 | ||

Total liabilities | 53,328 | 63,325 | ||

Commitments and contingencies | ||||

Redeemable preferred stock: | ||||

Preferred stock, $0.01 par value, 250,000 shares authorized as of March 31, 2023 and December 31, 2022. 144,212 shares issued and outstanding and $144,212 redemption value as of March 31, 2023 and December 31, 2022, respectively. | 144,212 | 144,212 | ||

Stockholders' deficit: | ||||

Common stock, $0.01 par value, 5,000,000 authorized shares; 3,434,294 and 1,758,421 shares issued and outstanding, respectively, as of March 31, 2023 and 3,432,294 and 1,783,862 shares issued and outstanding, respectively, as of December 31, 2022. | 34 | 34 | ||

Additional paid-in capital | 149,170 | 149,010 | ||

Retained earnings | 38,528 | 41,516 | ||

Accumulated other comprehensive income | 20 | 20 | ||

Treasury stock, at cost, 1,675,873 shares as of March 31, 2023 and 1,648,432 shares as of December 31, 2022. | (281,974 | ) | (280,470 | ) |

Total stockholders' deficit | (94,222 | ) | (89,890 | ) |

Total Liabilities and Equity | $ | 103,318 | $ | 117,647 |

View source version on businesswire.com:https://www.businesswire.com/news/home/20230515005457/en/

CONTACT: Investor Relations

T: +1-704-275-9113

E:IR@AltisourceAMC.com

KEYWORD: VIRGIN ISLANDS (U.S.) CARIBBEAN UNITED STATES NORTH AMERICA

INDUSTRY KEYWORD: BANKING ASSET MANAGEMENT PROFESSIONAL SERVICES FINANCE

SOURCE: Altisource Asset Management Corporation

Copyright Business Wire 2023.

PUB: 05/15/2023 08:15 AM/DISC: 05/15/2023 08:17 AM

http://www.businesswire.com/news/home/20230515005457/en