Thai investors are pinning their hopes on the general election to revive stocks in Asia’s worst-performing market this year, as parties across the spectrum promise tens of billions of dollars in economic stimulus.

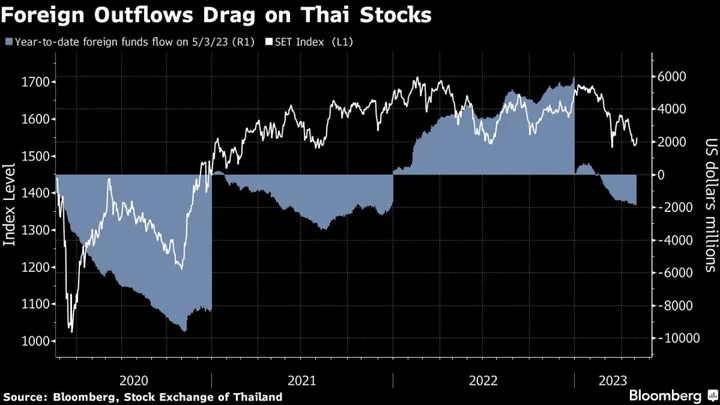

The benchmark SET Index has slumped 6.4% in 2023, defying expectations that it will repeat a rally seen in the run-up to prior elections. Instead, foreign investors have withdrawn nearly $1.8 billion as Thailand’s economic growth outlook lags that of its Southeast Asian peers, with the central bank’s tightening focus a key drag.

The unfavorable macro backdrop may be offset by optimism following the May 14 election, where surveys project opposition parties to win a majority to end nearly a decade of military-backed rule. Pheu Thai, which has an edge over others, has promised a cash handout, minimum-wage hikes and an array of measures to resuscitate the economy.

READ: Thai Party Pledges $15 Billion Tokens to ‘Resuscitate’ Economy

“The fiscal stimulus by the new government should further accelerate economic growth, fueling corporate earnings growth and share prices,” said Varorith Chirachon, executive director at SCB Asset Management Co., Thailand’s largest private money manager. “We still maintain our view for share prices to rally.”

In the previous five elections, the SET Index rallied an average 5.5% in the three months heading into the polls and posted similar gains in the following month, according to Kasikorn Securities Pcl and Maybank Securities Thailand Pcl. Analysts expect strong market reaction this time around if it looks clear that a single party, or a stable majority, will take control.

With competing political parties espousing policies that “mostly focus on solving economic problems,” the SET Index will “rally as usual,” said Therdsak Thaveeteeratham, an analyst at Asia Plus Securities Pcl. He sees May as a “good accumulation point” and recommended stocks with promising profit growth such as Indorama Ventures Pcl and Bangkok Expressway & Metro Pcl.

Whether any post-election rally will have staying power depends on the country’s growth outlook, with an expected boost from Chinese tourists offset by a broader slump in global demand.

The finance ministry lowered its forecast for this year’s economic expansion to 3.6% from 3.8% earlier amid weak exports. That compares with growth rates of 4.9% and 5.6% expected for Indonesia and the Philippines, respectively, in Bloomberg surveys. A lack of clear majority following the election may also lead to an overhang period for Thai equities.

But optimism is prevalent with the election just a few days away, with market watchers picking key beneficiaries.

Investors should focus on domestic-oriented sectors such as banking, commerce and health care, which has historically outperformed during the election rally period, said Nuttachart Mekmasin, a strategist at Trinity Securities Co. “Market will react well if there is a scenario that one party-government could be formed.”