A normally boring corner of the UK investment market is wobbling, highlighting the potential trouble ahead for corporate debt exposed to inflation.

Thames Water, Britain’s largest water supplier, is in talks with government officials about its options for dealing with its more than £14 billion ($17.8 billion) debt pile. Its burden has grown more onerous in large part because of its use of inflation-linked bonds, which account for more than half of its senior debt and has remained high in the UK.

As central banks hike rates to tame inflation, companies have faced immediate hits in at least two ways: they’re paying more interest on their floating-rate debt, and their inflation-linked obligations are growing bigger. There’s more than $1.8 trillion of this kind of debt outstanding worldwide that was sold in capital markets, most of which is leveraged loans, but also corporate floating-rate notes, and inflation-linked securities.

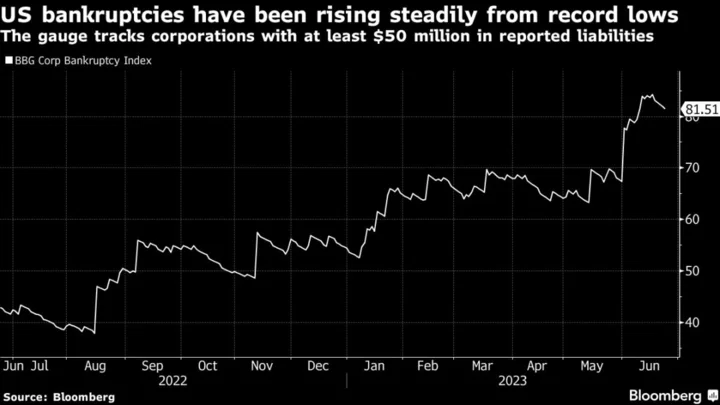

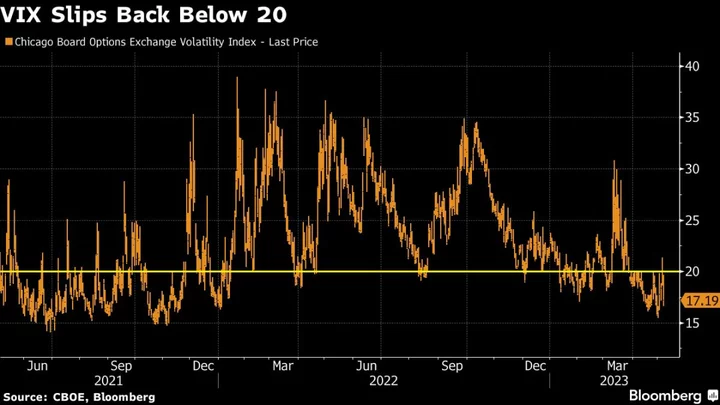

The outlook for much of that debt is getting worse, with Fitch Ratings citing inflation uncertainty as one of the reasons for lifting its default rate forecast for US leveraged loans to as much as 4.5% this year from a January forecast of as little as 2.5%. BNP Paribas analysts this week advised clients to sell leveraged loans in the US rated B- because of some companies’ unsustainably high interest expenses.

Companies that rely on floating-rate debt will be “heavily affected” by the higher-for-longer rates environment, said Michael Koehler, a credit strategist at Landesbank Baden-Wuerttemberg. He expects most other corporations to escape relatively unscathed.

Now Thames Water’s struggles have shifted the spotlight to British utilities. More than half of the £60.6 billion ($80 billion) in debt issued by water companies in England and Wales is indexed to inflation, according to Ofwat, the industry regulator.

UK companies account for nearly a third of the inflation-linked corporate securities globally. Only Brazilian corporations are bigger borrowers in the space.

The blow to the utilities could have been cushioned by using derivatives to protect against spiraling inflation but several firms failed to do so. Many private equity firms have also been hit by their decision to opt against hedging arrangements that, for most of the last decade, could have shielded companies for very little cost.

Read More: Hedging Failure Hammers Private Equity as Debt Costs Skyrocket

To be sure, the majority of the global corporate debt market consists of fixed-rate obligations that will only become painful once the time to refinance them comes.

Still, companies with high levels of floating-rate and inflation-indexed debt may end up needing the most relief, and may find themselves with few options for fixing their trouble.

“In a context of higher rates, we see private credit and loans as more vulnerable than public credit as their financing terms are more often floating rate and they have fewer financing alternatives,” said Elisa Belgacem, a senior credit strategist at Generali Investments.

Week in Review

- The three-month London interbank offered rate for dollars fixed for the final time on June 30, ending 50 years as a global benchmark.

- Ken Griffin’s market-making powerhouse Citadel Securities LLC is challenging Wall Street banks on their own turf as it enters the multitrillion-dollar world of corporate debt.

- Foreign borrowers are raising a record amount of yuan debt in China, as lower interest rates and looser rules boost the appeal of a market designed to help internationalize the nation’s currency.

- Middle East cash, Greek banks and a UK fintech company: New investors are dipping into the $1.3 trillion collateralized loan obligation market, tempted by some of the highest yields in more than a decade.

- Canadian pensions are piling into private debt, but there may be more private credit distress to come.

- Bonds issued by Indian companies saw their biggest foreign inflow in five years as the nation’s largest ever low-grade local currency debt sale — from Goswami Infratech Pvt. — drew a slew of overseas investors attracted by the high yield on offer.

- A feel-good rally that brought yields for the world’s worst rated bonds to a four-month low has come to an abrupt end.

On the Move

- Oaktree Capital Management has named Robert O’Leary and Armen Panossian as co-chief executive officers, selecting two veterans to lead the firm from the first quarter of next year. Jay Wintrob will leave after almost a decade as Oaktree’s first CEO.

- Credit market veterans Michael Goldstein and Josh Neren are leaving BDT & MSD Partners, the advisory and investment firm backed by Michael Dell, and spinning off a fund they co-run into a new venture, according to people with knowledge of the matter.

- Clarke Adams, managing director and head of US leveraged finance syndicate at Morgan Stanley, has departed the bank, according to people familiar.

- Jefferies Finance LLC has hired Vincent Ingato from ZAIS Group LLC as a managing director, according to people familiar. He will be a portfolio manager for collateralized loan obligations in his new role, one of the people said.

- Bank of Nova Scotia credit trader Alex Lederman is departing the Canadian lender, according to people familiar.

--With assistance from Taryana Odayar and Dan Wilchins.